Although Ethereum is currently trading above $1,800, it is still having trouble rising to higher heights. Following a slight rebound in recent weeks, ETH and the larger cryptocurrency market are again confronted with a crucial resistance area that may possibly trigger a breakout rally or result in further consolidation. To confirm renewed momentum, bulls need to break through the $1,850–$2,000 range, but macroeconomic headwinds are making that more challenging.

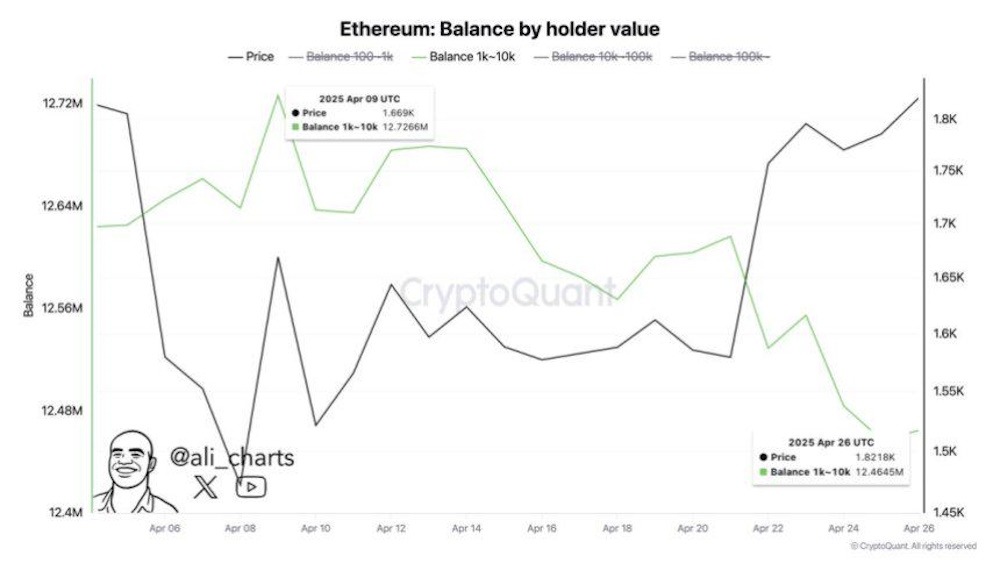

Investor mood is nevertheless impacted by the ongoing uncertainties around global economic slowdowns and US-China trade tensions. The climate is still unstable and susceptible to changes in geopolitics, even though risk assets have demonstrated resiliency. Large holdings seem to be exercising caution in this situation. Whales profited from Ethereum’s recent price spike, selling 262,000 ETH over the last few days, which is worth about $445 million, according to statistics from CryptoQuant. This notable selling wave points to prominent players taking profits, which can momentarily limit upside possibilities. There may be additional pressure if the market is unable to effectively absorb this supply.

After shedding more than 55% of its value from the December highs, Ethereum is still having trouble regaining its positive momentum. The market as a whole is cautious because ETH is still under pressure and trades below important resistance levels, despite recent attempts at recovery. Ethereum is currently testing a critical zone that could influence its short-term trajectory, hovering just above the $1,800 level. ETH is starting to take on a more positive structure on shorter time frames, which could indicate that bullish momentum is developing. The goal of bulls is to retake important supply zones between $1,850 and $2,000, which would signal a change in the dynamics of the market. But there is still a lot of selling pressure. Analysts are keeping a careful eye on Ethereum to see whether it can maintain higher lows and move closer to breakout levels.

However, not everyone believes that the market will continue to rise. During the most recent price spike, whales sold almost 262,000 ETH, which is worth almost $445 million, according to statistics just released by top analyst Ali Martinez. This selloff suggests that bigger players might be getting ready for a possible retreat or more volatility, which might put a stop to any short-term rebound attempts. Ethereum runs the danger of reverting to lower demand zones between $1,500 and $1,600 if it is unable to overcome the current resistance and withstand persistent selling pressure. To maintain the positive outlook for the time being, holding over $1,750 is crucial. Ethereum is in a precarious position, ready either for a major breakout or a fresh fall, as long as macroeconomic uncertainty and market-wide hesitancy persist.

At $1,810, Ethereum is presently trading within a small range of $1,850 and $1,750. The market is currently waiting for a clear breakout to set the tone for the next significant move after this tight consolidation that has persisted for several days. In order to validate the recent momentum shift that started earlier this month and confirm a breakout, bulls need to retake higher levels.

ETH is holding above important levels. Recent attempts to move higher have been restricted by the $1,850 resistance, and every rejection close to this level increases pressure. A verified breakout above this level would probably lead to more purchasing activity and move ETH closer to the crucial supply zone between $2,000 and $2,100. Bulls still need to regain this range in order to create a solid rally and change the general mood.

But rejection is still a possibility. It is anticipated that ETH would correct toward the lower end of the range if it is unable to break over $1,850 or experiences a fakeout. A significant decline below $1,750 might lead to a more thorough retracement, with support at $1,600 or below as the target. Given the ongoing macroeconomic uncertainties, Ethereum’s next action will probably determine the direction of the altcoin market as a whole in the next weeks. We’re running out of patience—volatility is on the way.